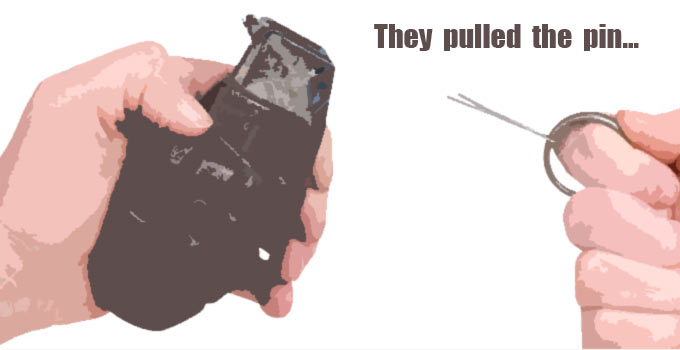

Get Back To Basics – The Pin Has Already Been Pulled

Systemic Risk – It’s Going To Crash…

Our future, be it soon or later, will be thrown into devastating crisis.

The building systemic risks are gathering from all corners, from all sides, at a frightening pace. And more are speaking up about it.

These risks stem from the present global financial/socioeconomic systems which are rapidly approaching peak debt / peak sustainability.

The details get complicated. However the 30,000 foot view is this:

It is requiring more and more debt at a increasing rate to create so called ‘growth’ (even though growth is actually more debt), and the lenders (global banking systems) are now trapped. We will (soon?) be facing collapse or inflation/hyperinflation. Both are very bad.

There are some very prominent people who are now saying that the pin has already been pulled, so to speak. They are saying “When is Now”.

One voice is Jim Sinclair. He hasn’t interviewed in 2 years, until recently (with Bill Holter and Greg Hunter). He is certain that the pin has been pulled and the “when” is “now”.

He is calling for preparations and preparedness for what is to come – which will lead to a ‘reset’. He actually believes there will be two. The first will fail and the second will succeed.

He (and others) believe that we will soon be facing massive social strife, civil war, and extreme hardship.

The short of it has to do with increasing interest rates in a global system that is HIGHLY LEVERAGED from zero (and near zero) interest rate policies, and easy money.

You might be saying, so what? it’s all gobbledygook.

Well here’s why you should be concerned…

When Credit Seizes, Distribution Fails

Most don’t realize this, but we live within a system that is keeping us alive “just in time”. In other words, everything we buy at any store (food & groceries or anything else) got there “just in time” for you to buy it.

Most things don’t sit on the shelves for very long. And most things come from VERY FAR AWAY. They get to you through intricate systems of distribution, often from other countries. We literally rely on these systems for survival.

However the appearance of “plenty” hides this fact.

We are evidently facing a slowing and/or seizure of the system to perform.

These systems operate and function on a thin margin of profitability. If the systems of distribution cannot get the credit they need, they will cease to function as they do today.

Most people think that there are “little Elves” working in the back at Walmart making the stuff that goes on the shelves. They have no clue whatsoever of the complicated and inter-related factors that get product from point of origin to those shelves. And the biggest factor is the availability of cheap credit.

The problem is, the issuers of cheap credit are in a box. They can’t do it anymore. They’ve used up their ammo. If they do, there will be a series of cause-and-effects that will lead to high inflation and then hyperinflation (massive quantitative easing). This will destroy the current system. Either way, things are going to be bad.

What can we do?

We can’t stop it. So we need to prepare for it.

Back To Basics

The most important preparedness actions that you (we) can take is to get back to basics. And that means everything from your own personal finances to your own survival.

When the system seizes or crashes or resets, whatever monies you have in banks, brokerages and financial institutions will not be in your possession. Look into it. Those monies are actually not yours anymore. You just have a claim on that money. In any bankruptcy proceedings you will be the LAST on the list to get the scraps of what may be left (which will likely be nothing or something worth much less). And if you think that .gov FDIC has enough money for a crash, think again. They don’t.

Get back to basics. What is money, really? It is a store of your labor, your wealth. You might seriously consider storing some of that ‘money’ into your own ability to survive a collapse. Because when it happens, that will be it. What you have in your possession will be all there is. It is a scary thought indeed.

Here’s another scary thought… For those of you with pensions or counting on pensions, look what’s happening in Venezuela and other countries, RIGHT NOW… that $2500 the following month might only be worth $1250 (even though the digits still say $2500). Then the next month it might only be worth $600. See where I’m going? Hyperinflation. That’s what happens. You’re screwed.

Again, back to basics. How can you turn today’s monies into tangibles that will help you to survive tomorrow? Before it’s too late…

I talked about this recently in the following article:

Your Labor – What Are You Working For?

We would all like to think that everything’s going to be fine and our economic future will carry on without any major disruptions. I would like to think that too! The problem is, the more that I read and educate myself about what’s really going on, the more alarmed I become (why did I take the red pill?!).

I’ve been self educating on these subjects for many years. And I suppose this has somewhat to do with why I’m preparedness-minded.

Given recent information I am re-evaluating my present needs towards better odds of survivability following socioeconomic collapse and/or high inflation / hyperinflation.

I suggest that you do the same (re-evaluate).

If the pin has already been pulled, we’re just waiting for the kaboom.

I have this book that you might find helpful:

Back to Basics