The Bank Pyramid Scheme | Inching Closer To Toppling?

The banking system is pretty much like a pyramid scheme in my view. A pyramid scheme that’s deceptively legal. Although if you or I, or any business tried this, we would be jailed for fraud!

If you ever wondered how the bank system works (in layman’s terms), here’s one explanation…

The banks count on the following assumption:

That most people won’t figure out the apparent Pyramid/ Ponzi scheme.

While you might think that after you’ve deposited your money, that your money remains in the bank – you would be wrong…

Fractional Reserve Banking

The bank begins the pyramid scheme by taking your deposit (which you might think goes into the vault), but they loan most of it out. In fact, generally, with some variation, for every $1 dollar that you deposit, the bank may loan out approximately $10!

In other words, the bank uses your deposits to loan out more (way more) than they have in reserves, in order to make big profits. This is ‘Fractional Reserve Banking’. The banks only keep a fraction of the overall money on hand.

An effect of loaning out ten times more than the bank has in reserves, the money supply is increased – created out of thin air. Poof.

This scheme works only so long as people don’t start asking for their money back!

Oh by the way, the money you deposit in the bank is technically no longer yours anyway. During the recent G20 meeting of NOV-2014, apparently the member nations decided that your bank deposits will become property of the bank if a crisis takes it down (a bail-in).

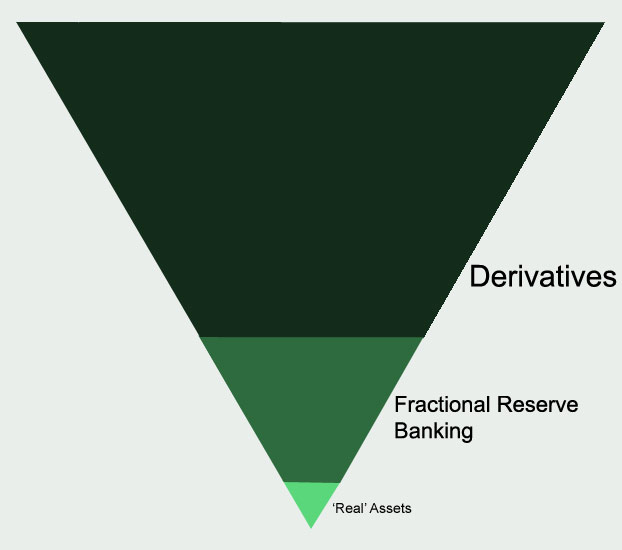

Upside-Down Pyramid

To visualize Fractional Reserve Banking, think of a pyramid upside-down, with bank assets being a small point at the bottom while all the debt and loans are piled on top.

How easy might it be to fall over? It needs to be very balanced!

I wonder how much of a financial ‘breeze’ to tip it over?

Central Banks

The ‘Federal Reserve’ is the Central Bank of the United States. It is at the center of our financial system. They (actually the US Treasury) prints money (currency). The Federal Reserve controls interest rates, and they loan money to commercial banks.

The Federal Reserve vs. US Treasury

The way it works: The 12 Federal Reserve Banks place orders with the Comptroller of the Currency (of the US Treasury). After reviewing the requests, the Comptroller forwards them to the Bureau of Engraving and Printing. The Federal Reserve Banks then distributes the new currency for the U.S. Treasury Department.

Low Interest Rates

Today’s interest rates for such transactions are very low (given the perpetual state of boosting our current economy and the apparent necessity for near ZIRP – zero interest rate policies).

By the way, today’s ‘money’ (currency) is actually called ‘Fiat’. A fiat money system is one of paper/digital-digits with zero backing except the government’s promise to pay (vs. no gold backing up the system).

The Central Bank (The Fed) lowers the interest rate when the economy is slow, with the intent to stimulate more borrowing (the system always NEEDS MORE DEBT to stay afloat).

Today’s low interest rates and easy credit (easy money) have resulted in more speculative risks (bubbles) than even before the 2008 ‘crash’. In other words the pyramid is even more top heavy than ever before…

Derivatives

Sitting on top of the inverted pyramid of the banking system are the Derivatives. Similar to Fractional Reserve Banking, it is yet another scheme in which bankers gamble huge amounts of ‘money’ with only tiny (fractional) underlying assets.

I read a description once which stated, “Think of a dollar bill in a Hall of Mirrors. There is only one dollar, yet there appears to be hundreds more. Bankers can use these hundreds of dollar bills, even though they are not really there.”

Thoughts

When you think about today’s ‘dollar’, the unit in which we are required to trade and exchange our work and productivity for, it is interesting to realize how we are actually exchanging a piece of essentially valueless paper.

I read this comment recently which I found interesting:

I’m a Banker. For those of you that haven’t yet figured out the scam, let me explain it to you.

Let’s say I have some sand I can loan you with interest. But I won’t accept the interest payments (sand) from any other source than mine, because all other sand is counterfeit under my laws. Only my sand will be acceptable as interest payment. Which means you will have to borrow even more of my sand, in order to pay me back the interest (in sand).

You don’t have to be a genius to figure out that it basically means you will never be able to get out of debt, unless of course, you forfeit something of value of yours in exchange for my sand.

Which is my intention all along – to steal your land, resources, your labor, your flesh and all your assets. Oh, and to pay me rent. And taxes.

Given the (likelihood?) of eventual or impending toppling of the pyramid (it’s inevitable, isn’t it?), I personally feel safer by eliminating debt, and exchanging some amount of fiat currency for hard tangible assets. Assets which will help in self reliance, self sufficiency, and sustainability.

Though I hope the system doesn’t crash in my lifetime, I’m not counting on it ‘not crashing’. I’ve made adjustments to my lifestyle, assets, and other areas for just-in-case…

This article has been updated and re-posted for your interest. It’s still valid today, and we’re in even more debt (and apparent systemic risk) than ever before…