Property Taxes – How High Are Yours?

Taxes. It’s part of life.

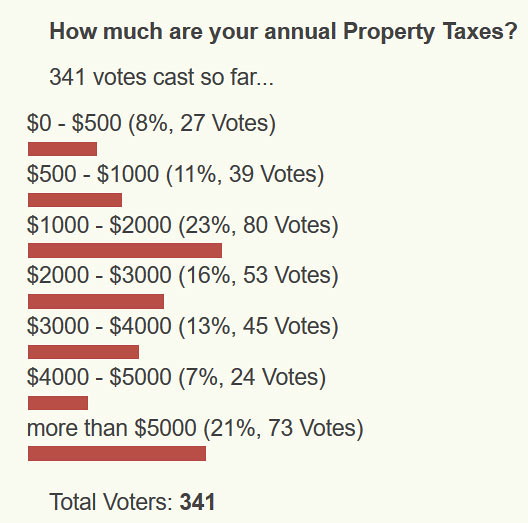

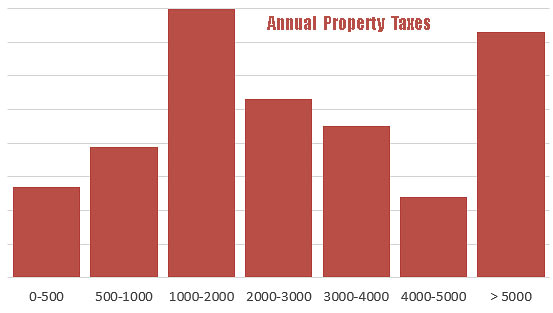

UPDATE: The poll question results are in:

“How much are your annual property taxes?”

(Jump directly to poll results)

I’m not aware of anyone (other than politicians) who likes taxes.

When we are taxed by the government (federal, state, or local), what we are doing is (forcibly) giving up some of our money so that government may redistribute it elsewhere. We don’t have a choice in the matter. Well, actually we do, to an extent…

We have a choice of moving to other places – where tax burden may be less. Though moving is a major life changing event, we do have the ability to do so.

With that said, overall tax burden can be tricky. Taxes are collected in a multitude of ways. Income, Sales, Property. Business taxes. Hidden and semi-hidden taxes. There are all sorts of taxes you’re paying. Government gets their take on seemingly every transaction where money changes hands.

Some governments are resorting to ridiculous methods. One recent proposal that I heard about from the government in New Jersey – they want to tax you based on the rain. Yes, a rain tax.

I’m getting way off track here. I don’t mean to gripe about the many forms of taxation. I’m just curious to discover how much people are paying for just one of the many forms of taxation: Property tax.

Property Tax – How Much are you Paying?

I know that property tax is just one part of the bigger picture. States collect their taxes one way or another, be it a piece of your income, sales tax, property tax, or other fees.

Here are the results of our reader poll question,

“How much are your annual property taxes?”

From 341 entries,

Observations: It looks like the sweet spot is between $1,000 and $2,000 based on our own poll results across the country (and our demographic for this blog). But with that said, clearly (in second place) many people are paying in excess of $5,000 a year in property taxes.

Of those who commented below (as of this update 2/23/19), states that had two or more entries, here are the averaged (non scientific) results – though interesting nonetheless:

Highest to lowest:

Illinois $5525

New Hampshire $4367

New York $4033

Washington $3854

California $3157

Texas $3033

Colorado $1790

New Mexico $1350

Florida $1340

Kentucky $800

Overall, within the comments below, 23 states were represented. Again, non-scientifically (due to variations of home value, county, some 1-vote per state, etc..) here are those averaged results:

Massachusetts 8200

Illinois 5525

New Hampshire 4367

New York 4033

Washington 3854

California 3157

Texas 3033

Virginia 2600

Oregon 2200

Colorado 1790

Tennessee 1738

Nebraska 1700

Arkansas 1400

Michigan 1400

New Mexico 1350

Florida 1340

Montana 1300

South Carolina 803

Kentucky 800

Nevada 742

Arizona 600

Wyoming 570

Idaho 500

I realize that property taxes vary (sometimes widely) depending on the valuation of one’s home (McMansion vs tiny house). And as it relates to the surrounding region, county, and the demands of local/state government there.

However it might be interesting to get average property tax numbers in this poll – enabling comparison to what others are paying. Are you in the middle? Paying more? or paying less than average?

Too bad I couldn’t add a additional reference to which state your entry may apply to within this poll. But my polling software is fairly simple. Plus, it may not be that telling because often it’s more closely tied to the county level than the state, with some exceptions. Additionally, states with no income or sales tax will have higher property taxes (money’s got to come from somewhere…).

Anyway, given the recent article, “Best States To Live A Preparedness Lifestyle” – I thought this might be interesting too.