Buy Tangible Hard Assets With Your Devaluing Dollars

Dollars vs. Hard Assets. While we need dollars to pay bills, purchase consumable supplies, and accumulate savings, the dollar constantly depreciates. The dollar is not an investment; it is only a medium of exchange.

I write this during a time of global financial and economic volatility. The world’s nations and people are drowning in debt. But it’s worse than that. Most people don’t know that our monetary system is built on debt, which requires ever-increasing debt for sustainability. The problems began when the dollar system, which was previously backed by gold, went off the gold standard. This shift led to a system where currencies were no longer directly linked to a physical commodity, leading to increased volatility and the need for more debt. With that said, here’s my concern…

We might be approaching the end of the current monetary system. A replacement is on the horizon. And when this change happens, we will all be affected. The ‘value’ of the ‘money’ you have could be reduced to a fraction. Imagine waking up one Monday morning to realize your dollar’s worth has been halved. But the situation could be even more unpredictable…

Worse yet is the possibility that ‘they’ cannot implement a replacement system before it collapses. This worst-case scenario would be horrific for most people as the system freezes and supply chains come to a screeching halt.

Which scenario is more likely? In my view, the monetary reset, although I do not rule out the possibility of a black swan event taking it down first.

So, what should you do? Please don’t worry to the point of panic, which may lead to dumb decisions like selling off all your investments or making large, impulsive purchases. Instead, think about it, and consider exchanging some of your debt-based dollars into tangible hard assets, especially those that contribute to your preparedness for a monetary reset or, worse, a partial or complete economic collapse.

What are some of those hard assets? Those that help sustain your well-being, such as a good quantity of storable food for your household, and any supplies you feel will contribute to survival and security.

It’s clear that you’re interested in prepping and preparedness, and that’s a great mindset to have. Consider tangible hard assets such as food and water filtration for safe drinking. Imagine all the elements that would contribute to your sustainability.

Energy is a BIG ONE. A solar/battery generator would be another priority for me. It’s a long-lasting and reliable energy source, rechargeable by the sun or other means. They vary from small to large, depending on your intentions. An alternative energy source was one of my first significant priorities when I became a prepper in earnest. I started small and gradually built up my energy storage capacity to the point where I can run my homestead essential systems nearly endlessly, so long as I get some sun now and again.

Security is a major consideration, particularly in the event of potential collapse conditions. What tangible assets could enhance your security? This largely hinges on your location. While deterrence and avoidance are key, it’s important to be mindful of how your location impacts your security. Take steps to avoid becoming a target, but also ensure you have the necessary tools and methods to protect yourself.

As you can see, I am focusing on investing in practical, hard assets that contribute to survival. Land, a tangible, hard asset favorable to growing food and land away from dense populations, is a practical choice. While it may seem costly, exchanging dollars for such assets is another valuable and sensible way to invest and prepare.

Think of the many consumable supplies that you go through on a daily or weekly basis. Which of those would you miss most if supply chains were disrupted? Maybe all of them? Those things would be good to stock up on by exchanging your devaluing dollars for hard assets.

As of this writing, the global economy is in flux due to tariffs on goods from other countries (among other reasons). This highlights the importance of understanding the origins of the products we use. The typical middle-class lifestyle, which has been in relative balance with income, debt, and the availability of affordable goods, is now under strain. The increasing debt and costs are disrupting the stability of this system, underscoring the need for mitigation.

If you are fortunate to have excess dollars, consider your survival and preparedness. What can you buy today that will help you in a world of tomorrow?

The time to act is now. What if things cost two, three, four, or more times as much in the future, or what if many or most things became unobtainable? What would you buy now to help mitigate this potential problem? Don’t wait, take action now to secure your future.

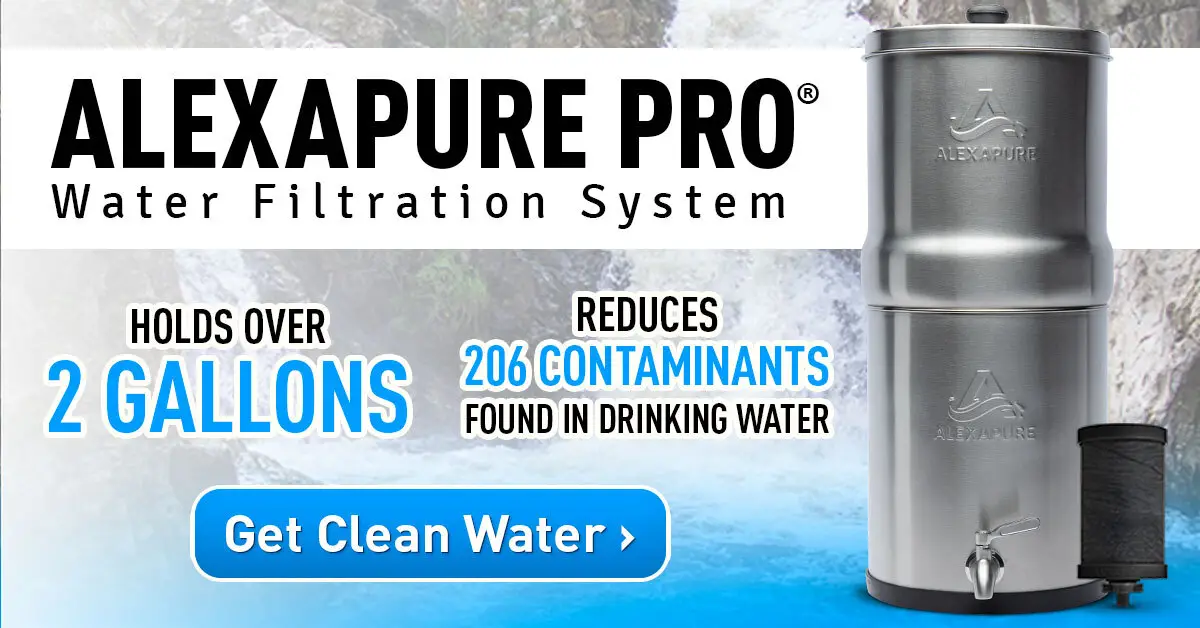

Among the highest priorities for survival is safe drinking water.

AlexaPure Pro Gravity-Powered Water Filtration

Tested against NSF/ANSI 53, NSF/ANSI 42

You have any recommendations for a solar battery generator? We already have a whole house generator but it only really has about two weeks of continuous output. What are some good options at least for small things? At the very least like keeping communication devices charged? Maybe some options for small – medium – and large capacity. Money is tight too. Also what brands or stores to avoid, etc.?