State Income Tax Comparison

State Income Tax Table

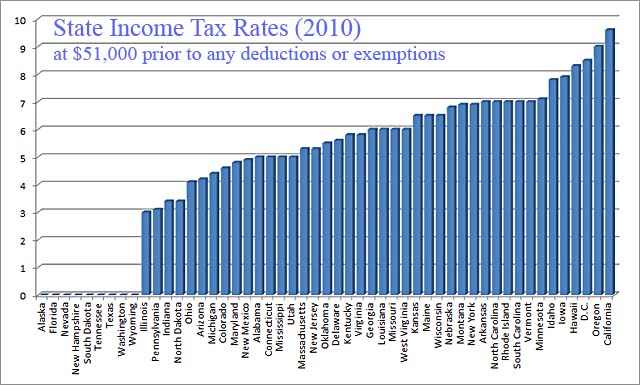

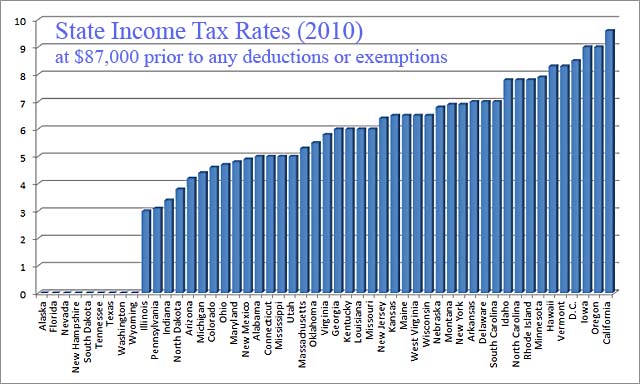

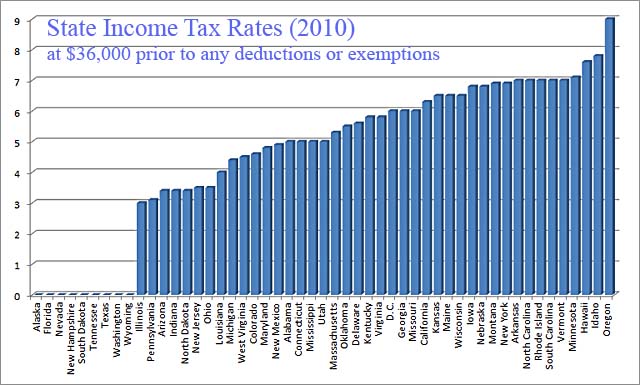

2010 Individual Tax Rates (percentage)

Rounded to the nearest tenth

Not including whatever state deductions that may exist

Although New Hampshire and Tennessee are listed as zero income tax, they do tax on interest and dividend income at 5% and 6% respectively.

Three income levels were chosen. A lower-than-average income, a probable somewhat average income, and a higher than average income, so as to show any variance in tax rates that may exist at those levels.

| State | 2010 rates $36,000 |

2010 rates $51,000 |

2010 rates $87,000 |

| Alaska | 0 | 0 | 0 |

| Florida | 0 | 0 | 0 |

| Nevada | 0 | 0 | 0 |

| New Hampshire | 0 | 0 | 0 |

| South Dakota | 0 | 0 | 0 |

| Tennessee | 0 | 0 | 0 |

| Texas | 0 | 0 | 0 |

| Washington | 0 | 0 | 0 |

| Wyoming | 0 | 0 | 0 |

| Illinois | 3 | 3 | 3 |

| Pennsylvania | 3.1 | 3.1 | 3.1 |

| Arizona | 3.4 | 4.2 | 4.2 |

| Indiana | 3.4 | 3.4 | 3.4 |

| North Dakota | 3.4 | 3.4 | 3.8 |

| New Jersey | 3.5 | 5.3 | 6.4 |

| Ohio | 3.5 | 4.1 | 4.7 |

| Louisiana | 4 | 6 | 6 |

| Michigan | 4.4 | 4.4 | 4.4 |

| West Virginia | 4.5 | 6 | 6.5 |

| Colorado | 4.6 | 4.6 | 4.6 |

| Maryland | 4.8 | 4.8 | 4.8 |

| New Mexico | 4.9 | 4.9 | 4.9 |

| Alabama | 5 | 5 | 5 |

| Connecticut | 5 | 5 | 5 |

| Mississippi | 5 | 5 | 5 |

| Utah | 5 | 5 | 5 |

| Massachusetts | 5.3 | 5.3 | 5.3 |

| Oklahoma | 5.5 | 5.5 | 5.5 |

| Delaware | 5.6 | 5.6 | 7 |

| Kentucky | 5.8 | 5.8 | 6 |

| Virginia | 5.8 | 5.8 | 5.8 |

| D.C. | 6 | 8.5 | 8.5 |

| Georgia | 6 | 6 | 6 |

| Missouri | 6 | 6 | 6 |

| California | 6.3 | 9.6 | 9.6 |

| Kansas | 6.5 | 6.5 | 6.5 |

| Maine | 6.5 | 6.5 | 6.5 |

| Wisconsin | 6.5 | 6.5 | 6.5 |

| Iowa | 6.8 | 7.9 | 9 |

| Nebraska | 6.8 | 6.8 | 6.8 |

| Montana | 6.9 | 6.9 | 6.9 |

| New York | 6.9 | 6.9 | 6.9 |

| Arkansas | 7 | 7 | 7 |

| North Carolina | 7 | 7 | 7.8 |

| Rhode Island | 7 | 7 | 7.8 |

| South Carolina | 7 | 7 | 7 |

| Vermont | 7 | 7 | 8.3 |

| Minnesota | 7.1 | 7.1 | 7.9 |

| Hawaii | 7.6 | 8.3 | 8.3 |

| Idaho | 7.8 | 7.8 | 7.8 |

| Oregon | 9 | 9 | 9 |

A quick look at state income tax in a bar-graph format provides a good visual reference where your state tax ranks with all other states.

Sate Income Tax Rate (percent)

Sate Income Tax (percent)

Sate Income Tax (percent)

Not only is the tax data and state comparison interesting to look at, but if you are ever considering a move to another state, this information should be of some help. This is intended only to be a guide and general view of where the various states rank.

If you enjoyed this, or topics of survival preparedness or current events risk awareness,

check out our current homepage articles…