Best Ways To Invest Your Money Rather Than The Bank

Dennis recently said,

I retired 13 years ago.

That first year, I purchased 45 acres adjoining my homestead for $500 an acre. Total investment $22,500.

When I retired, I left $400 in a savings account at my employee credit union, just to keep the account active.

Thirteen years later the land I purchased for $500 an acre is surrounded by land that sold recently for $2,000 an acre. A 300% increase in value.

The savings account increased to a total of $459. A 15% increase.

– Dennis (a MSB contributor)

Here’s the question,

Because banks don’t provide any resemblance of a decent rate of return on your bank account, what are the best ways to invest your money?

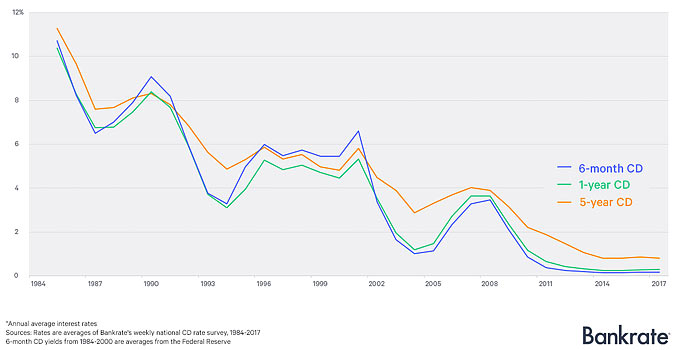

The policies of the ‘Federal Reserve’ (and global banking) have kept interest rates very low for a very long time. This has forced money to other places looking for a return on investment more than just a fraction of a percent at your local bank.

While not everyone is afforded the ‘luxury’ of having excess money to invest, some do. So lets talk about it… Modern (economic) Survival.

You want to invest in assets (not liabilities). You might say that primary asset classes include Real Estate, Businesses, and Paper assets (stocks bonds notes, etc). They offer potential return on investment or cash flow.

The first thing that people will say is The STOCK MARKET.

The stock market is such a broad term though. The focused (or general) investment choices are numerous. Winners and Losers. Conservative investments and Risky investments.

But has the market run-up reached plateau? There are many who think the stock market is so overvalued that you’d be crazy to jump in. Others think there’s still plenty of opportunity.

We hear about the stunning returns on cryptocurrencies like Bitcoin and others. Countless millionaires have been created from relatively small investments. Maybe cryptocurrency technology investments are only in their infancy. Maybe, maybe not.

What market sectors do YOU believe to be good investments for the future?

There’s always risk in the stock market. Yet nearly everyone with money invests there.

What about other investments?

Precious metals? Gold or Silver? That’s been a joke since 2011… Are powerful entities keeping their prices suppressed? Many believe, yes.

We keep hearing from ‘gold bugs’ that it’s going to break out any day now… Yet the powers-that-be keep the economic collapse genie in its bottle. Gold and Silver remain in a fairly narrow price range.

I personally still believe that holding some is a good investment under certain conditions and scenarios (not all).

Real Estate values have been going up and up in most places, but even though you might sell for a nice return, you’ve got to live somewhere and you’ll pay more there too (unless you move to a suppressed area and pocket the difference).

Some may invest in real estate as a landlord (everyone has to live somewhere so this makes some logical sense). But not everyone can put up with the hassles of being a landlord. And what if prices do fall in the future? Again, risks.

Land. This is tricky. What are you going to do with that land? Subdivide and sell? That’s risky too, unless you have a sure-thing. Will you just hold on to it hoping that land values go up until one day you sell it? Ever heard of “location, location, location”?

I believe that if you’re a homesteader capable person, buying land that can produce for you may be a good thing. Even a very good thing. Building and establishing a homestead involves time and work. Not everyone has the time and not everyone wants to ‘work’. But you are investing in yourself in this regard. Given that we’re a preparedness blog, many here either already are doing this or would like to.

Invest in yourself. I really like the idea of putting your money into yourself. This is a broad concept but it applies in many areas.

– your health and well being

– ways to produce (and preserve) your own food

– things that reduce your reliance on others

– small business to make extra money

– pay off debt (should be high priority)

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

The concept of investing is to expect a return on investment. That’s why it’s done. A ‘return’ might be valued in today’s currency (dollars) or it might be valued in other ways (peace of mind, self sufficiency & self reliance, and many others).

There are many individual paths to wealth and they don’t all involve money.

What are your opinions on best or better ways to invest one’s money?

Be as general or specific as you’d like.

More: 5 Steps BEFORE You Retire

More: Property Taxes – Lowest to Highest by State sorted by dollars