State Income Tax Comparison

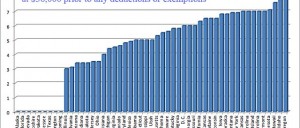

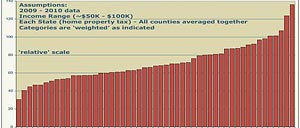

State Income Tax Table 2010 Individual Tax Rates (percentage) Rounded to the nearest tenth Not including whatever state deductions that…

State Income Tax Table 2010 Individual Tax Rates (percentage) Rounded to the nearest tenth Not including whatever state deductions that…

One way to look at State tax burden when comparing one state with another, is to use the same weighting…

Wondering which U.S. State may be better to live in regarding their taxes and tax burden? While we cannot escape…

Permalink Shop smart and save money. This time I want to share with you the sale I took advantage of…